More Profit and Less Stress: A Guide To Use Profit First in your Business

A revolutionary system that helps entrepreneurs turn their businesses into profitable ventures.

Promote yourself to 2.5k+ subscribers by sponsoring this newsletter!

Sponsoring newsletters, like mine, is a great way to reach engaged and targeted audiences. It will build up your brand!

Today at a glance:

Are you tired of feeling like your business is constantly struggling to make ends meet? Do you feel like no matter how much revenue you generate, you never seem to have enough profit left over at the end of the day?

If so, you're not alone. Many entrepreneurs struggle with the same problem.

But there's a solution: “Profit First”

It is a revolutionary system outlined in the book of the same name, by Mike Michalowicz that helps entrepreneurs turn their businesses into profitable ventures.

The system is based on a simple premise: “Allocate profit before paying expenses”

This means that instead of waiting until the end of the year to see if your business has made a profit, you take your profit out first and run your business on what's left.

A Framework:

At its core, Profit First is a cash management system that flips traditional accounting on its head. Instead of relying on the old formula of:

Sales - Expenses = Profit

Profit First switches to:

Sales - Profit = Expenses

By allocating the profit before expenses you ensure that your business is always making money, rather than just breaking even or operating at a loss.

It is really that simple! But more deep and powerful than you think.

How do you put the profit before expenses?

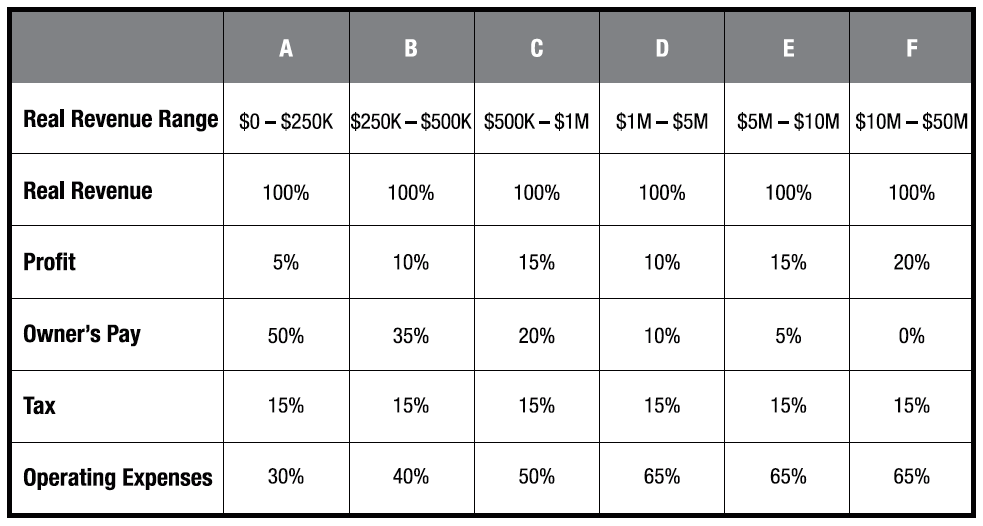

The goal is to allocate your income into different accounts based on percentages. These accounts are:

Income Account:

This is the account where all your income is deposited. You will allocate funds to the other accounts from here based on the recommended percentages.

Profit Account:

This account is for profit distributions to the owner(s) of the business. This account should receive 5-15% of your income.

Owner's Compensation Account:

This account is for your salary as the owner of the business. This account should receive 50-60% of your income.

Tax Account:

This account is for taxes that you will owe the government. This account should receive 15-20% of your income.

Operating Expenses Account:

This account is for all your business expenses. This account should receive 30-35% of your income.

It's important to note that these percentages are recommendations and can be adjusted to fit your specific business needs. However, the overall idea is to prioritize your profit and pay yourself first, then make sure you have enough for taxes and expenses.

The beauty of the Profit First system is that also encourages you to be more mindful of your spending and focus on growing your business in a sustainable way.

Of course, implementing this system isn't always easy. It takes time and effort to set up the necessary accounts and to get used to managing your cash flow in this way. But the benefits are clear - increased profitability, better cash flow management, and peace of mind knowing that your business is financially stable.

Here are 7 tips to start implementing Profit First in any business:

Open Separate Accounts:

Open separate bank accounts for each of the categories: Income, Profit, Owner’s Pay, Taxes, and Operating Expenses. This is important to avoid cheating the system!

Determine Target Percentages:

Determine your target percentages for each account. Remember, this is not a one-size-fits-all solution, so you need to customize it to fit your business needs. The idea is to start small and move towards your target percentages each month (or each quarter).

Allocate Income:

Every time money comes into your business, allocate it to the appropriate accounts according to your target percentages. If you do not want to do it every time money comes, ****I usually do it on the 10th and the 25th day of the month. A few days before I need to pay the bills! This gives me time to review my cash flow and everything without being late!

Cut Operating Expenses and Increase Revenue:

Look for ways to reduce your operating expenses so that you can increase your profit margin.

Focus on increasing your revenue by finding new customers or selling more to existing ones.

Pay Yourself First:

Always prioritize paying yourself first. This will help you to stay motivated and focused on growing your business.

Set Aside Funds for Taxes:

Set aside funds for taxes so that you don’t get hit with a surprise bill at the end of the year.

Get Professional Advice:

If you’re struggling to implement Profit First or want to optimize your results, consider working with a financial professional who can provide expert guidance and support.

I am a business consultant with extensive experience in implementing Profit First (and other methodologies, automation, and systems) in many businesses. Therefore, I can help you with this!

If you are interested in a 30-minute business consulting session, just reply to this email. No charge!

Now that you have learned the basics about the Profit First system, it's time to take action and start implementing it in your business. Remember, this system is designed to help you achieve long-term financial success, so don't be afraid to take small steps and make gradual changes.

As you begin to see the positive impact on your business, don't forget to celebrate your progress and use it as motivation to keep going. You can achieve your goals and build a thriving, profitable business with consistent effort and a commitment to financial discipline.

So, what are you waiting for?

A Tool:

Getting started with a Business can seem overwhelming. But don’t worry!

It’s actually fairly simple if you have a basic structure to hit the ground running.

I have developed what I think is the most professional and powerful Notion tool for any companmy: Business OS.

Each section is based on extensive research with colleagues and entrepreneurs so you will find all the tools you need, in just one workspace!

I build a Basic Version and a Demo so you will have enough to try it out!